Thematic OTT Services: The Art of Attraction

What attracts subscribers to sign up for one streaming service over another? We asked respondents to Digital TV Europe’s 2020 Annual Industry Survey as part of the thematic OTT services section what they believe makes consumers more likely to choose. Over 93% of respondents said that original content was either very relevant or moderately relevant, while over 87% felt the same about exclusive content. This was closely followed by an attractive or competitive price.

As expected, content is still considered the best incentive for viewers to sign up and return regularly to a service. In fact, over 62% of survey respondents consider an out-of-date, or rarely updated library of content, as one of the key reasons people are likely to opt-out of a subscription. This means streaming services need to offer their users enough content that interests them: and keep it coming!

Some operators, including the likes of Disney, have responded to the viewer’s demand for more by bundling services together (The Disney bundle includes access to Hulu, Disney+, and ESPN+). According to a study commissioned by Vindica from nScreenMedia in 2019, the average American subscriber now watches 3.4 services. Loading up on subscriptions may give viewers more choice, but it doesn’t alleviate the bugbear of having to scroll through multiple services to find what interests them. It’s not necessarily cost-effective for the viewer either.

Not surprising then that we’ve seen the conversation and interest in thematic OTT services increase in recent years. Unlike broad mainstream players, thematic services appeal to niche interests and aggregate consumers with similar interests, not content. As part of the DTVE survey, respondents were asked how likely they believe thematic or niche streaming services are to attract consumers that already subscribe to one or two general entertainment streaming offerings. Respondents agreed that those who already subscribe to one or two generalist streamers such as Netflix or Amazon Prime Video are more likely to complement this with a thematic offering than with a third general entertainment service. 66% of respondents believe users are much more likely or somewhat more likely to add a niche service to their existing streaming portfolio.

At Magine Pro, we believe we’re likely to see more market growth with thematic OTT services over general entertainment offerings in the coming years. This is particularly interesting for new market entrants and existing players looking to refine their content offerings.

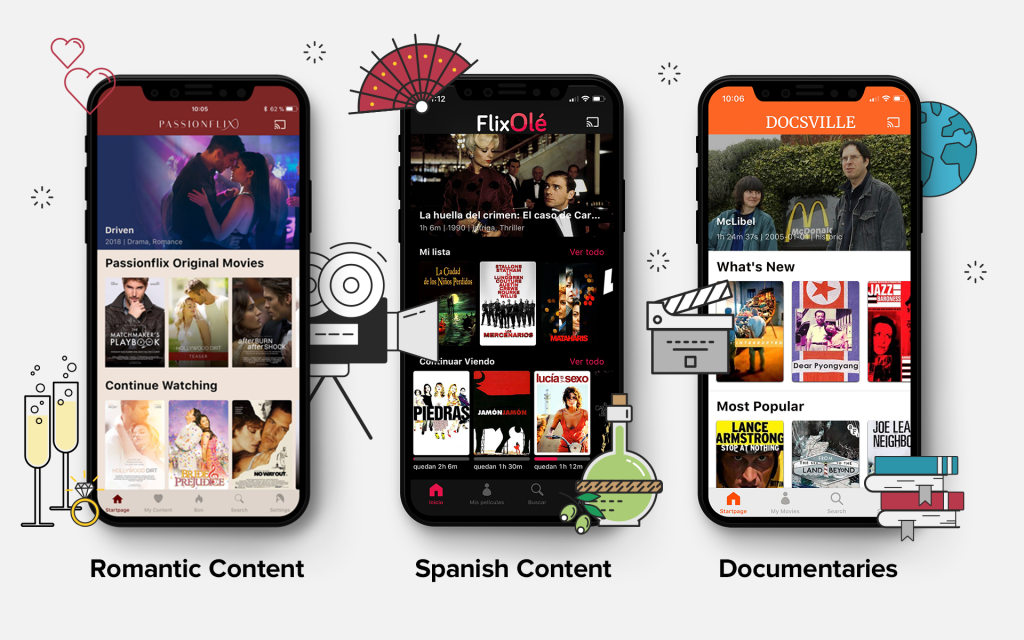

Our partners PassionFlix, FlixOlé, and Docsville are great examples of successful thematic services. Each specialises in a particular genre of content as opposed to general mass appeal programs and movies.

For new market entrants, determining what genre/s to specialise in will depend heavily on the markets they want to enter into. Understanding the target audience and their viewing behaviours is vital to the success of any streaming service. As part of the DTVE survey, we also asked industry respondents their view on what genres or interests are best suited for new thematic streaming services. Sports and kids programming came out on top as the most promising genres, with an honourable mention going to services aimed at specific expatriate or migrant groups.

You can find out more about Digital TV Europe’s Annual Industry Survey 2020 here and download the report in full.

To find out more about our partners, PassionFlix, FlixOlé, and Docsville, who operate niche services, head over to our Experience page. You can also find out more about Magine Pro video streaming services, and in particular how we can help you build your own Thematic OTT service, here.

Don’t forget to subscribe to the Magine Pro newsletter to stay up-to-date with our latest news, partners, products, and to find out which industry events we’ll be attending next. You can book in a meeting now on our events page; meet the team and demo our OTT services firsthand.