Operators and OTT, live together in perfect harmony

“The modern media company must develop extensive direct-to-consumer relationships, we think pure wholesale business models for media companies will be really tough to sustain over time.”

-AT&T Chairman-CEO Randall Stephenson during his latest investors call explaining his company’s vision of how to stay relevant to consumers in the fight against Netflix and Amazon, and the rationale behind AT&T’s acquisition of Time Warner.

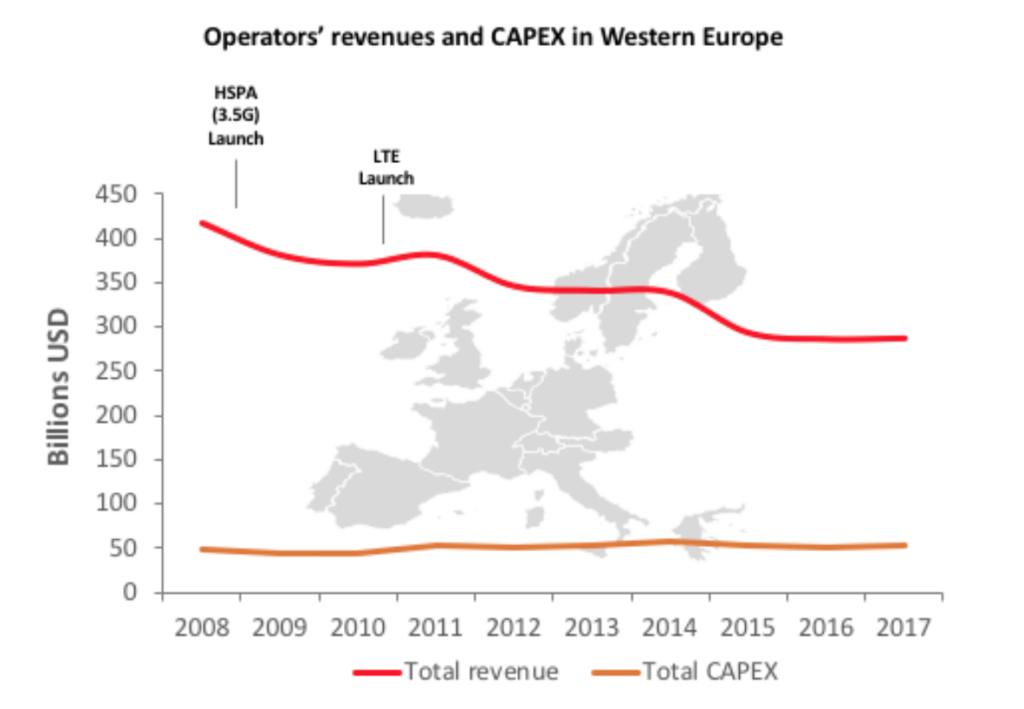

Randall’s statement is understandable, as Mobile Operators today are feeling the pressure to find the next revenue growth driver. Over the last 10 years, Operator’s revenues have been in decline (as shown in the Northstream graph below), with investments (CAPEX) required for the growth of mobile data consumption remaining flat.

Source: Northstream

Vertical integration is the name of the game

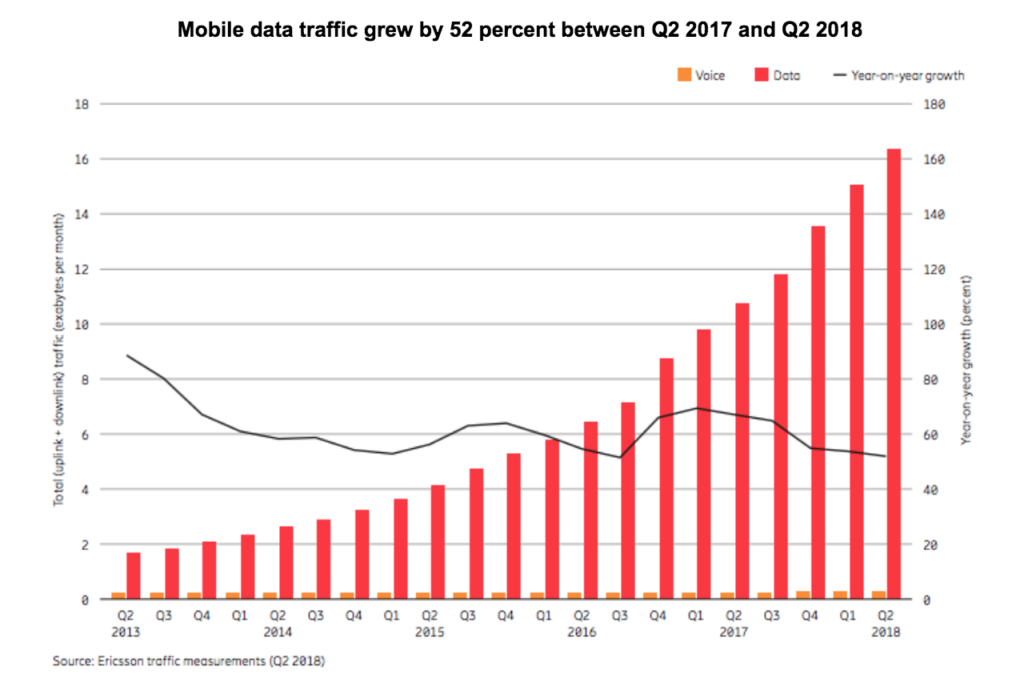

As the graph below demonstrates, mobile data traffic is still showing tremendous growth, and with cord-cutting reaching new heights, it’s no surprise Operators are taking a page from the ol’ strategy playbook and begun acquiring content and media companies to achieve vertical integration.

Source: Ericsson

The simple objectives of such vertical integration-deals are scale and to retain customers by expanding the control and ownership of the value chain, bundling all consumer services such as TV, Internet, Phone and OTT into one discounted package and locking the consumer in the Operator ecosystem. Recent examples of this are AT&T’s acquisition of Time Warner and Swedish Telia’s acquisition of Bonnier Broadcasting.

Through acquisitions like these, Operators can consider themselves providers of everything from infrastructure to content production and consumer technology. However, it’s important to remember that the only consistently profitable business operators have ever had is the provision of connectivity and infrastructure. There are many examples of operators who have dabbled with innovative new services in an attempt to compete head-on with start-ups when market dynamics and status quo have been disrupted. Who, for example, remembers the bold aspirations and goals of Vodafone 360? Or the ambitious operator application service platform, IP Multimedia Subsystem (IMS), which was to be a worldwide deployment of mobile telecommunications networks to offer operator-managed Video, Voice and Business services online, without forcing subscribers to change carriers.

The market, however, ended up going in a different direction, with the ecosystems eventually being controlled by Apple and Google, and OTT new entrants providing superior Voice, Messaging and Video services, as well as ease of use for consumers, bypassing any attempt of an Operator ecosystem. Now, Operators find themselves locked in cut-throat competition with these OTT challengers for what they considered their core business.

The Operators’ Gordian knot

So how then can Operators untie their Gordian knot of 1- exploding growth of mobile data traffic, 2- flat or decreasing revenue, and 3- competing with innovative and fast-moving OTT challengers? Just as Alexander the Great disentangled the impossible knot by simply cutting it loose with his sword, so should Operators. Rather than clinging to legacy market perceptions and ideas, resulting in ever more complex and unclear new initiatives, Operators should approach the issue as simply and pragmatic as possible. They should acknowledge the areas in which they excel, connectivity and infrastructure, and acknowledge what OTT challengers excel in, which is providing innovative and superior consumer services and content.

By entering into partnerships with OTT companies, Operators are able to leverage their true core competencies and provide superior customer experiences through OTT partnerships. We’re already seeing such partnerships becoming more common, with video services being the most popular area of collaboration between Operators and OTT.

Other interesting examples of partnerships are Operator investments in OTT aggregators and platforms. For example, Telia’s investment in SolidTango, enables the Operator direct access to a multitude of niche OTT services and content channels. And with the increased adoption of multiple OTT service subscriptions by consumers, as well as the growth of niche market OTT services, partnerships like these open up new levels of personalised packages that Operators could offer their customers.

Come together, right now

Operators and OTT companies are in a great position to work together and leverage each other’s strengths, rather than attempting to out-compete each other by limiting distribution or denying access to content. It is clear that what is best for consumers will in the long run also always be best for the companies serving said consumers, and those consumers are now voting more ruthlessly with their wallets than ever before. In a recent report by BCG, Video aggregators and Distributors are at risk of losing $30 Billion in profit as a result of current changes in the media market dynamics. Even though the future is still up for grabs, not all companies have the scale to keep up, and thus BCG predicts that “their best option is to pick a partner with a constellation of complementary content and assets under the best possible terms.” In the online video market of tomorrow, the writing on the wall is that Operators and OTT companies either succeed together or fail divided.

AT&T’s Randall Stephenson went on to also share his view on Netflix:

“I think of Netflix kind of as the Walmart of (video), HBO is kind of Tiffany. It’s a very premium, high-end brand for premium content.”

This is an interesting view given that Netflix received 118 Emmy nominations this year, which was more than HBO. Netflix will also spend 3x times as much as HBO on content productions this year. It would be interesting to know how Stephenson defines the high-end difference between Netflix and HBO. It does seem AT&T is committed to trying yet again to untangle their Gordian knot in a conventional way, but if it didn’t work before, will it work now?